By Cody Barilla, Grain & Oilseed Analyst

Report Snapshot

Situation:

The number of carbon programs that offer a payment for conservation practices has created significant confusion in the marketplace, and low returns on burdensome requirements have led to low participation rates for these programs.

Finding:

When carbon programs are appropriately stacked with other conservation-focused revenue opportunities, the total payout can prove profitable.

It is easy to get lost in the weeds on the contractual obligations, compensation and required practices to play in a carbon market. The hot topic today may revolve around carbon credits, but there are additional opportunities available to farmers and ranchers looking to add revenue streams to their farming operation through conservation. I have separated them into four buckets:

- Federal conservation programs

- Supply chain alignment

- Climate-Smart Commodities grants

- Carbon markets

Approximately $20 billion of Inflation Reduction Act funds will support the conservation programs of the USDA’s Natural Resources Conservation Service (NRCS).1 Of the $20 billion, $8.45 billion will go to the Environmental Quality Incentives Program (EQIP) and $3.25 billion will go to the Conservation Stewardship Program (CSP). Additionally, $3.1 billion of funding is allocated to Climate-Smart Commodities projects.2

Federal Conservation Programs

General EQIP, CSP and EQIP-CIC (Conservation Incentive Contracts) address their priority resource concerns, including sequestering carbon and improving soil health. Depending on where you are in the country, the NRCS targets different priority resources. These programs are voluntary and include a plethora of conservation practices, and different activities within those practices, for farmers to enroll in. The payment limitations are $450,000 for general EQIP and $200,000 for CSP and EQIP-CIC.3

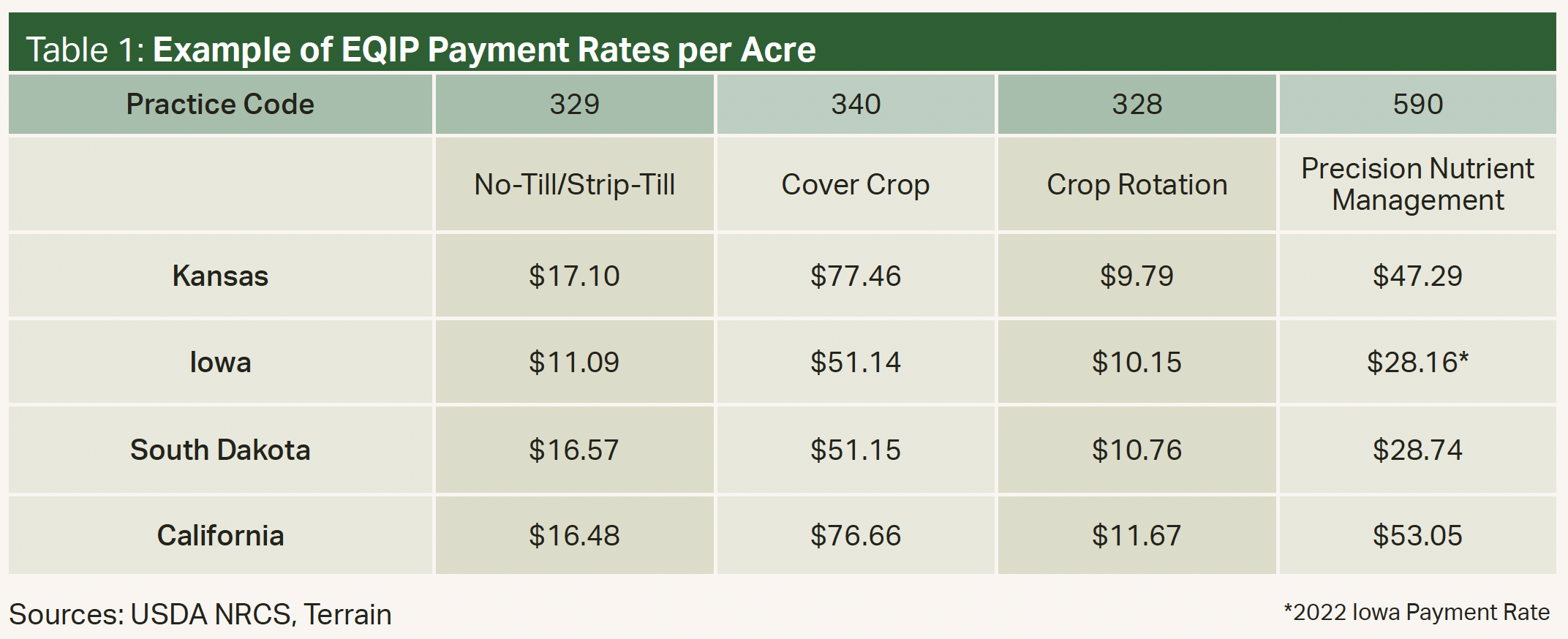

Table 1 shows an example of a five-year general EQIP contract that includes four practices: crop rotation, no-till/strip-till, cover crop and precision nutrient management. The payment rates vary from state to state, but for Kansas the fiscal 2023 payments are $9.79/ac. for crop rotation, $17.10/ac. for no-till/strip-till, $77.46/ac. for cover crop, and $47.29/ac. for precision nutrient management.4

Most crop rotations do not allow for a cover crop each year in Kansas due to moisture constraints. In the Kansas example, if a cover crop is planted in two years of the five-year contract, that equates to $525.82/ac. over the life of the contract. Given the payment limitation for general EQIP is $450,000 for a five-year contract, a farmer could maximize the payment with 856 acres.

This example comes with obvious costs such as the cover crop seed and drilling, but some of these can be offset by the agronomic, crop production and operational efficiency benefits that result from the practices.

Providing the necessary documentation and record keeping to meet NRCS contract requirements has been a barrier to entry in conservation programs. To help remove this hurdle, Technical Service Providers (TSPs) offer planning, design and implementation on behalf of the NRCS. The NRCS provides cost-share funding, which can cover the cost of a TSP.5 A TSP can help design an EQIP contract, document the progress of the enrolled practices, write the report, and deliver on all of the required documentation on behalf of the farmer.

Any producer who is interested in improving soil health or exploring carbon markets should visit their local NRCS office, as other practices may also suit their individual operation. At the moment, EQIP and EQIP-CIC appear to be more appealing than CSP, since payment rates for CSP are approximately a third of what they are for EQIP and EQIP-CIC. In addition to payment rates, only EQIP and EQIP-CIC qualify for a TSP. All three programs offer similar practices to choose from.

Supply Chain Alignment

The second bucket for monetizing conservation is through supply chain alignment. ADM, Cargill, General Mills, Nestle, Grain Craft and many other grain buyers offer premiums to growers for sustainable practices such as reduced tillage, no-till, precision nutrient management, integrated pest management and crop rotation.

The idea of growing crops in a “sustainable manner” is vague and wide-ranging, but most buyers want traceability and documentation of conservation practices. Most farmers already have some sort of conservation practice in place. Aligning with a grain buyer’s supply chain is a way to be paid a premium for documenting these practices.

The 45Z - Clean Fuel Production Credit is a new tax credit under the Inflation Reduction Act that is in development. The 45Z tax credit is paid to biofuel producers based on low carbon intensity (CI) production. The CI score is based on not only the ethanol plant’s CI score but also the CI score of the feedstock producers use. This is where the potential revenue stream to the farmer comes in.

The current standard CI score for corn is 29.1 GHG/MJ of ethanol energy. The CI score is based on a Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation (GREET) model. The GREET model evaluates current corn production parameters such as type and amount of fuel, fertilizer and chemicals used on a per acre basis. The grower’s score is compared with the standard CI score to calculate the number of tax credits available to the ethanol plant.

The 45Z tax credit is set to begin in 2025, and the IRS is still ironing out the rules. While it may or may not lead to a potential opportunity for corn growers, the 45Z tax credit is an example of another supply chain alignment where end users pay for practices that farmers likely are doing already.

Climate-Smart Commodities Grants

Climate-Smart Commodities projects are a new pool of money for conservation funded by the Inflation Reduction Act. Many of these USDA-backed projects are in their pilot year and looking for farmers to participate.

One example is the Climate Smart Cotton Program administered by the U.S. Cotton Trust Protocol. The Climate Smart Cotton Program has two levels of payments: Level 1 is $5/ac. and requires enrollment and a self-assessment questionnaire. Level 2 is for producers interested in a practice change, with a $25/ac. payment for cover crop, a $5/ac. payment for reduced tillage, and/or a $5/ac. payment for nutrient management.

The Farmers for Soil Health (FSH) program is another example of a Climate-Smart Commodities project. The FSH program has two categories. One category, the Transition Incentive Payment, pays $50/ac. for producers planting cover crops for the first time on a particular field. The second category, Signing Incentive Payments, pays $2/ac. for participating in FSH measurement, reporting and verification on fields that are already planted annually to a cover crop.

Farmers can also stack FSH Transition Incentive Payments with other Climate-Smart Commodities projects, non-federal incentives and cost-share opportunities, but not with USDA NRCS cover crop share payments such as EQIP. Similar to other Climate-Smart Commodities projects, there are a limited number of acres to be enrolled in the project.

Carbon Markets

Despite the wide array of carbon market options for farmers, only 3% of farmers are actively participating in a carbon market.6 One reason farmers are hesitant about carbon credit and conservation programs through the USDA is the required “change in behavior,” also known as additionality.

If a farmer has been practicing no-till for many years, they will not receive a payment to continue practicing no-till. However, a farmer currently practicing no-till that adds a rye cover crop to the rotation would receive payment for the additionality. Not all Climate-Smart Commodities programs and supply chain alignments have this additionality requirement.

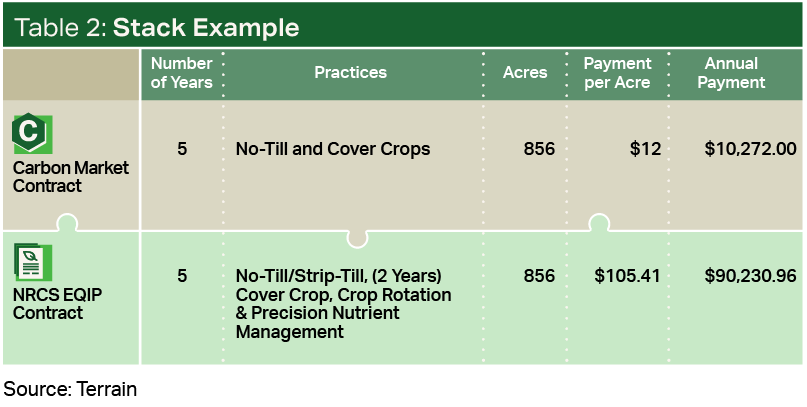

Another major stumbling block for most farmers to join a carbon market is the low payment rates. One opportunity available to farmers interested in carbon credits but not quite ready to commit would be to stack a carbon program on the same acres enrolled in an EQIP, EQIP-CIC or CSP contract. The USDA pays for the completion of the practice while the carbon programs pay for the results, also known as carbon sequestration. There are several carbon programs that have a five-year contract and are incentivizing the same practices such as a reduction in tillage, cover cropping, crop rotation and nutrient management.

Many producers are hesitant to enroll in a carbon program because of the vast carbon market offerings and different program requirements within each carbon market combined with the low value of carbon offerings, with most paying between $5/ac. to $15/ac. depending on the amount of carbon sequestered.

Stacking would allow farmers to test-drive a carbon market while having the reassurance of a USDA conservation payment. It may also be possible for carbon programs to be layered with supply chain alignments, but such an analysis is outside the scope of this report because of the substantial variability of the rules within each carbon market and supply chain alignment.

A Profitable Payout

As margins become tighter because of lower commodity prices, it is critical to find additional ways to add revenue to your farming operation. And it is very achievable to add six figures of revenue to a midsize farming operation through federal conservation programs, supply chain alignments, Climate-Smart Commodities grants and carbon markets.

Table 2 shows how an EQIP contract with 856 acres enrolled would bring in $90,000 per year, while enrollment of similar acres in a carbon market, Climate-Smart Commodities grant or supply chain alignment would bring in an additional $10,000.

For operations that are either currently practicing conservation or planning to add a conservation practice, documentation is a high-value use of time.

Works Cited

1 USDA, “Inflation Reduction Act Investments in USDA Loan and Conservation Programs,” August 16, 2022, https://www.farmers.gov/inflation-reduction-investments...

2 USDA, “Partnerships for Climate-Smart Commodities,” 2022, https://www.usda.gov/climate-solutions/climate-smart-commodities.

3 USDA Farm Service Agency, “Payment Limitations,” 2022, https://www.fsa.usda.gov/programs-and-services...

4 USDA Natural Resources Conservation Service, “Payment Schedules,” https://www.nrcs.usda.gov/getting-assistance/payment-schedules.

5 USDA Natural Resources Conservation Service, “Technical Service Providers,” https://www.nrcs.usda.gov/getting-assistance...

6 Cara Urban, Drew Slattery and Amy Skoczlas Cole, “Ag Carbon Markets and U.S. Farmers,” Farm Journal Trust in Food, May 1, 2022, https://www.trustinfood.com/wp-content/uploads/2022/05/Farm-Journal-Carbon-Whitepaper-2022.pdf.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.